Incentives to invest in networks

Back in June 2009, the presidents of DAVE Wireless, Public Mobile and Globalive Communications were on a panel together at The Canadian Telecom Summit talking about how they planned to address an “underserved market” for mobile services.

Each company believed there was a sustainable business case for a carrier that focused on value-conscious mobile service clients, not needing the same levels of investment in the latest technologies, or the spectrum to support high throughput. In some cases, the initial networks were built without LTE, or used non-standard ranges of spectrum.

A variety of issues arose, but each of the carriers learned that value-conscious consumers still wanted to be able to access the latest devices, or bring their devices from their previous service provider. At least one service provider found that it was unable to get a hold of the hottest devices until its network was upgraded to LTE.

And that brings us to today, where most service providers are in the midst of massive levels of capital upgrades, some CEOs have termed it “generational levels of investment”, to implement 5G services.

What are the 5G apps that will capture our imaginations? From a consumer perspective, if I knew, I certainly wouldn’t share my ideas in a public forum.

But we know that 5G enables far higher density of connected devices, with far greater data speeds and throughput capacity, and significantly reduced latency. At the time mobile networks were being upgraded to LTE, we didn’t know which apps would be enabled. This next generation is no different.

For service providers that choose not to invest in 5G, there may be a small window of opportunity to simply go after a budget conscious consumer. The challenge will be in retaining the majority of customers who want to be able to access the newest apps and capabilities, and don’t understand why those don’t work on their legacy devices.

Some of those apps won’t be on their hand-held devices, but may be embedded in their car. Or, home appliances. Or, store shelves.

So, what will happen to service providers that are unable (or unwilling) to keep up with the investment required to upgrade networks to 5G? The transition to 5G can be a factor to drive consolidation in the marketplace, as service providers look at the need for more pervasive backhaul facilities to support the increased density of antennas. Recall, Brad Shaw told Canada’s Industry Committee in March that “it is clear that Shaw cannot build what Canada needs on our own.”

Reducing the number of competitors does not necessarily translate to a lessening in competitive intensity in the marketplace. For example, take a look at Manitoba and Saskatchewan, where Shaw currently operates as a cable TV provider, but not as a wireless service provider. Rogers offers mobile services in both provinces. What happens to the competitive intensity for consumer services in those two provinces when Rogers and Shaw combine forces?

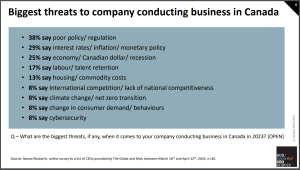

The best way to encourage sustainable competition – not just in telecom but for the benefit of the economy at large – is by maintaining incentives to invest, enabling and encouraging the massive levels of investment necessary to upgrade networks to 5G.

As Dr. Christian Dippon of NERA has said “Quite simply, a market cannot both be noncompetitive and offer some of the best mobile wireless services in the world.”