Canada’s policy environment is leading to the wrong climate for investment.

That is one of the key take-aways from a recent survey of leading business leaders published by the Globe and Mail. The survey [pdf, 5.2MB] included chief executives from a wide range of companies and business sectors, representing businesses with annual revenues ranging from $10M to more than $10B. Two thirds of the respondents represented companies with annual revenues over $1B.

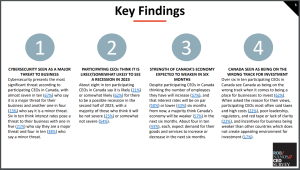

The survey’s headline highlights nine out of ten participating CEOs in Canada see cybersecurity as a threat for their business; 70% say it’s a major threat. Still, Canada being on the wrong track for investment is one of the 4 key findings. “Over six in ten participating CEOs in Canada see Canada as being on the wrong track when it comes to being a place for businesses to invest (62%). When asked the reason for their views, participating CEOs most often said taxes and high costs (22%), poor leadership, regulators, and red tape or lack of clarity (22%), and incentives for business being weaker than other countries which does not create appealing environment for investment (17%).”

The survey’s headline highlights nine out of ten participating CEOs in Canada see cybersecurity as a threat for their business; 70% say it’s a major threat. Still, Canada being on the wrong track for investment is one of the 4 key findings. “Over six in ten participating CEOs in Canada see Canada as being on the wrong track when it comes to being a place for businesses to invest (62%). When asked the reason for their views, participating CEOs most often said taxes and high costs (22%), poor leadership, regulators, and red tape or lack of clarity (22%), and incentives for business being weaker than other countries which does not create appealing environment for investment (17%).”

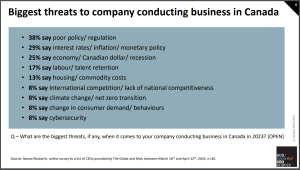

Further, when asked an open ended question “What are the biggest threats, if any, when it comes to your company conducting business in Canada in 2023”, 38% replied poor policy / regulation. It was the number one threat identified, by a nine point margin.

Further, when asked an open ended question “What are the biggest threats, if any, when it comes to your company conducting business in Canada in 2023”, 38% replied poor policy / regulation. It was the number one threat identified, by a nine point margin.

The regulatory and policy impact on the climate for investment is a key theme in the CRTC’s review of mandated wholesale access to fibre facilities. In its notice of consultation, the CRTC appears to trivialize the risk to further fibre investment by carriers, since fibre access networks “now cover most of their serving territories”. That stands in stark contrast to a recent statement by Bell Canada’s CEO that “There are still 4-5 million locations within our footprint without access to fibre.”

The regulator should know that broadband expansion business cases are examined on a project-by-project basis. After all, the CRTC administers its own subsidy fund to top up the shortfall in a limited number of rural broadband expansion projects. Policy makers must recognize that existing fibre is somewhat irrelevant to the millions of Canadian households that currently don’t have fibre access.

The economics associated with fibre expansion projects should be pretty simple to understand. I have written about broadband business cases numerous times. The incremental cashflows over time have to offset the upfront and ongoing costs associated with the project. If there is a shortfall, the project doesn’t get approved. If the economics don’t work, the private sector won’t invest in the project.

Cutting investment and cutting jobs aren’t threats; these are logical (and predictable) consequences of regulatory and government policy.

This week, we have seen stories about such consequences at TELUS and at Bell.

Will CRTC’s continued intervention in the marketplace drive an increased requirement for government funding for fibre in areas that would have otherwise had a business case for private sector investment?