Disappointment haunts my dreams

To paraphrase Neil Diamond’s song (recorded by The Monkees), disappointment haunts my dreams. In part, I think it’s because I’m a believer.

Why? I’m talking about watching last week’s emergency meeting of Canada’s Standing Committee on Industry and Technology (INDU), called to review the announcement that there will be price increases for some mobile customers – those not currently under contract – at some of the service providers. You would never know that Canada’s mobile prices are lower – much, much lower – in the past year if you watched that meeting. You would never know that the price increases aren’t across the board.

I wrote about this issue last week in advance of the INDU meeting. But during the meeting, there was so, so much misinformation being spewed that I had trouble figuring out where to start. Indeed, on Monday, National Bank Financial issued a report entitled “What To Make of Last INDU Meeting With Incorrect Statements”.

You can watch the 2-hour committee meeting yourself on ParlVu. In it, you will hear MPs say that the first thing that happened after the Rogers / Shaw / Quebecor transaction closed was prices going up. That simply isn’t true. A month after the deal closed, mobile prices fell. Indeed, they fell enough to warrant stories like “Rogers launches cheaper 5G cell phone plans, doubles data for its most popular plans” in the Globe and “‘A new era of competition?’: Rogers slashes prices for most of its fastest cellphone plans following Shaw takeover” in the Star.

As National Bank Financial observed in its note:

Conservative members of INDU made these statements on Jan. 11: “it was a promise that prices would go down…we realize now that it’s false”, “I don’t think I have a single constituent in my riding that would agree that cellphone prices have come down”, and “Rogers…made it very clear that this deal…would inject a new and substantial source of competition…and we didn’t see that”

It’s hard to reconcile these with reality.

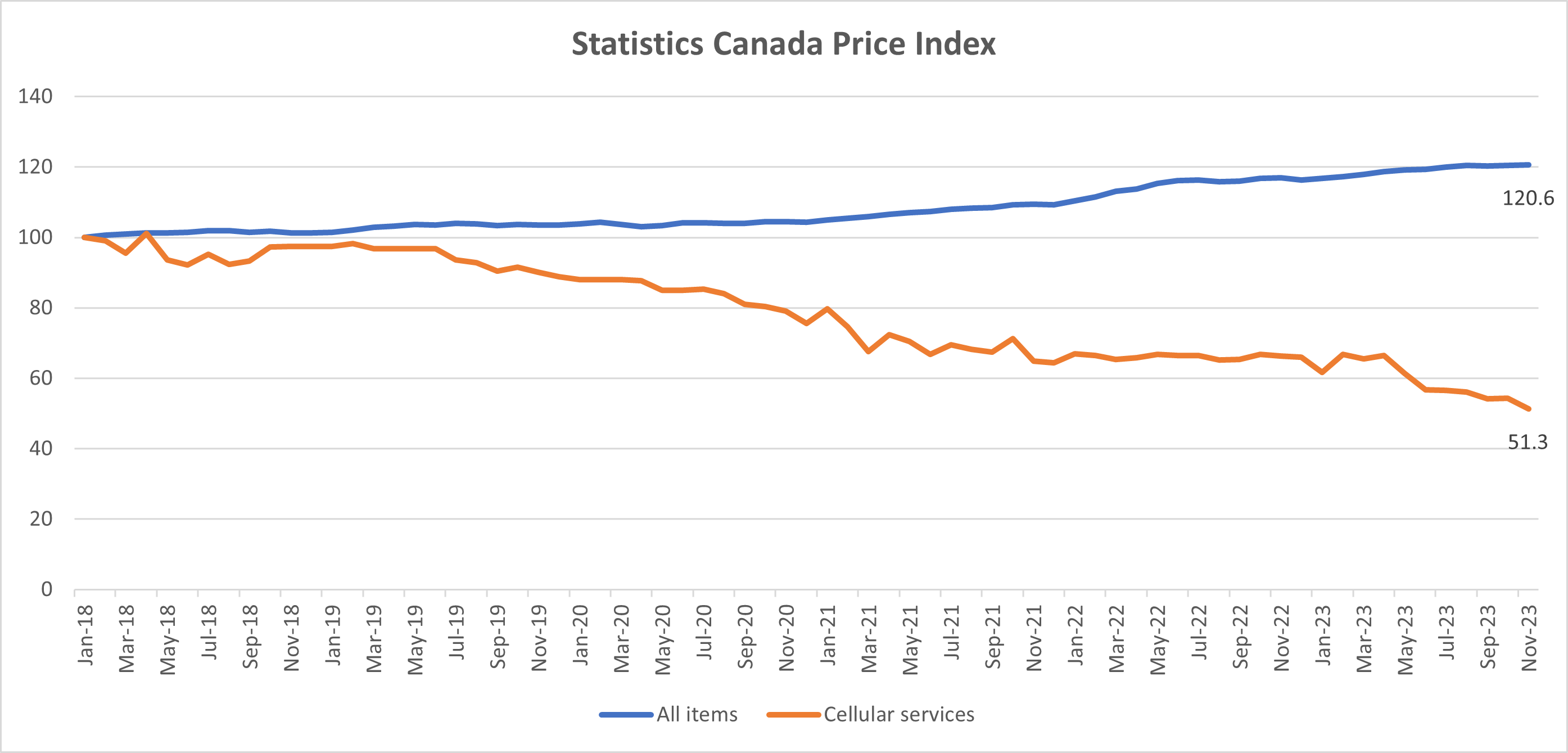

Aggressive price competition characterized the mobile market throughout 2023. This continued a trend of declining prices that has been going on for several years and has seen Statistics Canada’s Cellular Services Price Index decline by almost 50% in the last five years. A number of times in the past year, Statistics Canada pointed to mobile services as the largest downward contributor, moderating the monthly consumer price index. Last month, Statistics Canada wrote “Consumers who signed on to a cell phone plan in November paid 22.6% less than those who did so in November 2022” (The December CPI figures released earlier this week show that cellular services are down 26.8% compared to December 2022). New mobile options have also been introduced, with some service plans waiving roaming fees in destinations like the US and Mexico and 5G service being expanded to include some flanker brand offerings.

Aggressive price competition characterized the mobile market throughout 2023. This continued a trend of declining prices that has been going on for several years and has seen Statistics Canada’s Cellular Services Price Index decline by almost 50% in the last five years. A number of times in the past year, Statistics Canada pointed to mobile services as the largest downward contributor, moderating the monthly consumer price index. Last month, Statistics Canada wrote “Consumers who signed on to a cell phone plan in November paid 22.6% less than those who did so in November 2022” (The December CPI figures released earlier this week show that cellular services are down 26.8% compared to December 2022). New mobile options have also been introduced, with some service plans waiving roaming fees in destinations like the US and Mexico and 5G service being expanded to include some flanker brand offerings.

MPs cited so-called international price studies claiming Canada had the highest mobile prices in the world. That simply isn’t true. This blog has consistently pointed out the errors in methodology by many groups who try to undertake international pricing comparisons (such as Rewheel Research or Cable.co.uk). Last year, I wrote “Telecom Price Studies: 2022 Edition” (March 21, 2023) and “Trusted Sources For Telecom Data” (June 27, 2023) which should be good reference points for you. The posts would be even better starting points for Members of Parliament, and their staff.

In the INDU meeting, you will hear some Members of Parliament read correspondence from constituents who complain that they are paying over $250 per month for 2 phones and can’t afford an increase in price. If those MPs were really serious about helping their constituents, they would tell their constituents that mobile rates have dropped considerably and they should contact their service provider (or a competitor) to find out what better deals are available.

If consumers have an affordability issue, there are programs offered by a number of service providers to help disadvantaged households. These services are provided by the service providers with no government funding. In addition, to address those subscribers who only want a cell phone for emergencies or occasional use, the CRTC requires that the major mobile service providers offer a $15 plan with 250 MB of data, 100 minutes of outbound calling and unlimited inbound calling and SMS texting. It is worth noting that this CRTC plan skews Canada’s ranking in some international pricing studies because they attribute a $60/GB price to such a plan, even though no one seriously in the market for a data plan would select this mandated offering.

Time expired for the INDU Committee before the meeting could reach agreement on next steps. At some point, the Committee will be returning to undertake a more complete review of telecommunications, one that was proposed by Bloq MP Sébastien Lemire last September:

That, pursuant to Standing Order 108(2), the committee undertake a study on the modernization of the regulatory framework and the convergence of wired and wireless products to ensure that future decisions are informed by robust data and recommendations for the benefit of all consumers in terms of accessibility and affordability; that it examine this convergence with relevant stakeholders and what they can enable through technological advancements such as 5G, fiber optics, Wi-Fi 6, and many others; that it examine the need for ubiquitous connectivity, necessary data transmission speeds, and innovative opportunities for businesses and consumers in Canada and internationally; that it scrutinize the operating costs of these technologies and the maintenance of so-called critical infrastructure; that it examine the need for network resiliency in the face of climate change; that it specifically investigate unused spectrum in more remote and rural areas as well as deployment targets; that it examine the need to expand mobile connectivity to improve public safety, particularly along roads and highways; that it examine telecommunications tower construction programs and infrastructure deployment financing; that the Committee allocates a minimum of six meetings for conducting this study and that it report its findings and recommendations to the House.

It remains to be seen whether such a study will generate heat and smoke, but fail to create light. As National Bank Financial said “There will be more headlines and studies, but any analysis should be based on correct information.”

Watching certain Parliamentarians in Committee means that sometimes disappointment haunts my dreams. But, I’m still a believer.