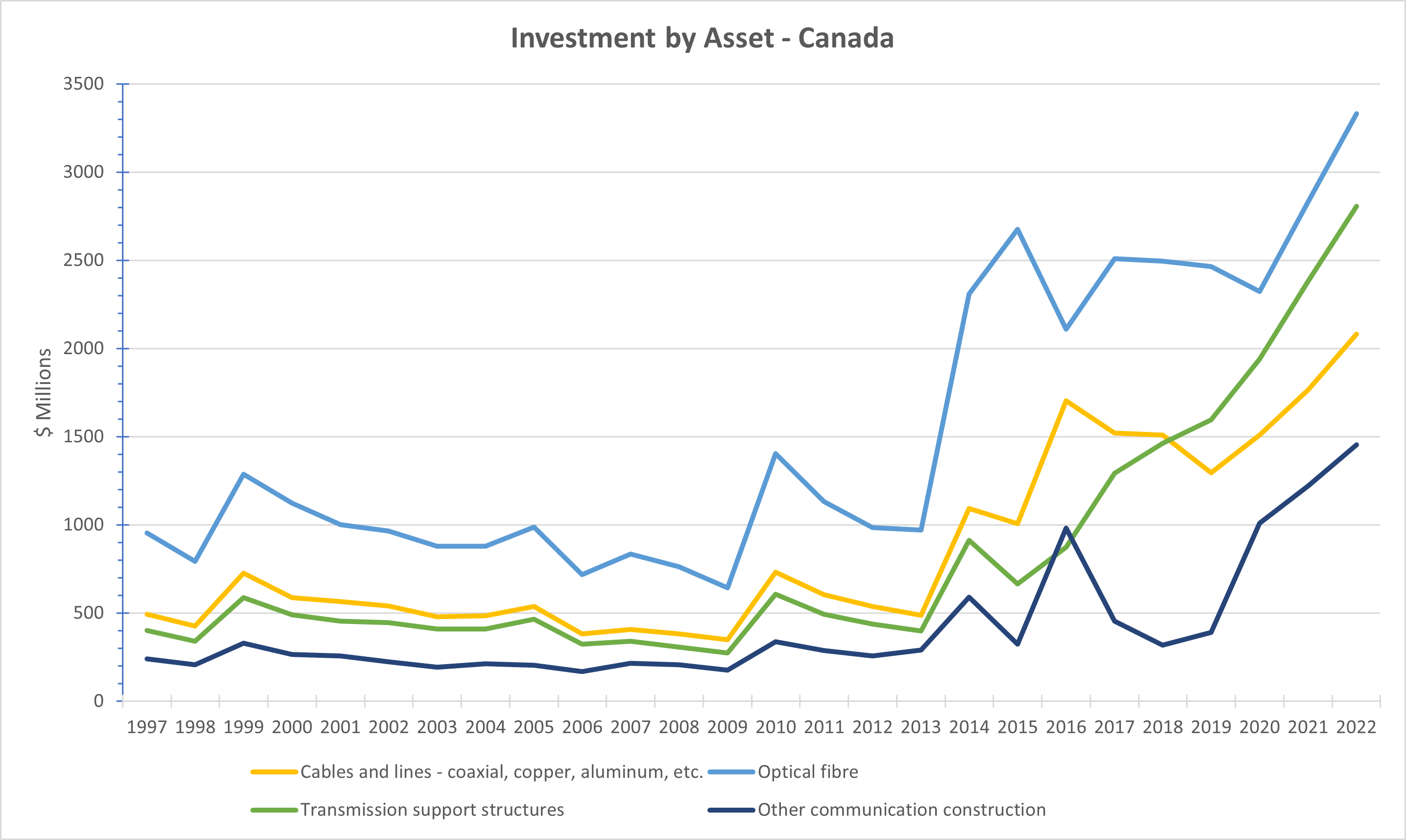

Canadian carriers have spent billions of dollars investing in telecom infrastructure.

Canadian carriers have spent billions of dollars investing in telecom infrastructure.

Indeed, Statistics Canada data shows that the year 2022 represented the greatest level of investment in communications networks on record ($9.674B). More than a third of that ($3.332B) was invested in Optical Fibre.

A few weeks ago, I highlighted an excerpt from the CRTC’s wholesale broadband notice of consultation. At paragraph 70, we read:

the Commission considers that a number of incumbent carriers have made fibre the focus of the retail Internet service market, resulting in a seven-year head start in establishing and securing a broad customer base by building out and deploying their fibre access networks, which now cover most of their serving territories. Therefore, the Commission expects that there would be minimal risk regarding the future investment of fibre deployment by accelerating the competitive introduction of FTTP facilities.

As I noted last month, Bell Canada’s CEO has stated “There are still 4-5 million locations within our footprint without access to fibre.” And, that is just within Bell’s footprint.

In 2016, when the CRTC set an aspirational target for all Canadians to have access to 50/10 unlimited broadband, it was viewed as an aggressive, but achievable goal. Seven years later, the FCC is considering a target of 100/20 for its rural broadband programs.

CRTC figures show that, at the end of 2021, 91.4% of Canadian households have access to 50/10 unlimited broadband. But barely over three quarters (77.4%) have access to gigabit speeds (a proxy for fibre or equivalent technology). In rural Canada, nearly two thirds (62%) of Canadians have access to the 50/10 unlimited service, but just over half of those (36.9% of total rural households) could get gigabit services.

The Commission’s own data demonstrates that the CRTC is just plain wrong to conclude “there would be minimal risk regarding the future investment of fibre deployment”.

In its recent submission to the CRTC’s wholesale consultation, the Competition Bureau explicitly warns the Commission about wholesale regulation creating a risk to investment.

Wholesale access regulation can increase competition in the short-term, including through offering increased choice and lower prices to consumers. However, it is worth noting that wholesale access regulation can also have a negative effect on investment decisions, potentially impacting long-term or dynamic competition.

Wholesale regulation can have a material impact on the business case for rural and suburban fibre deployment, as recognized by the Competition Bureau. The CRTC should be playing the long game, continuing to focus on a dynamic marketplace for the long term.

In the coming weeks, I expect to be writing more about the CRTC’s recent determinations in its “Review of the approach to rate setting for wholesale telecommunications services”.

Canadian carriers have spent billions of dollars investing in telecom infrastructure, but the job is not yet complete. This is not the right time for regulation to discourage carriers from investing in telecom infrastructure.

Indeed, there is never a “right time” for governments to discourage private sector investment.