Is it time for government telecom policy makers to say, “Mission accomplished”?

At a recent investor day hosted by TD Securities, Bell CEO Mirko Bibic said:

You talk about the competitive landscape or dynamics or intensity, I think it is to be fully expected. When you have four well capitalized companies who are integrated across wireless and wireline and, in several cases, broadcasting or media, it’s not surprising to me that there’s competitive behaviour we’re seeing across the board. Ultimately, it’s what you ought to want. As a consumer living in the country, it’s totally expected.

It should form part of a different type of dialog that we should be having. To the extent anyone thought there was an issue with competitiveness, haven’t we kind of solved it? You’re seeing the benefits of having four well capitalized companies operating across wireless and wireline, which by the way, you don’t see anywhere else in the world. Very few countries have four wireless players. And frankly, no countries have the ubiquity of fibre deployment that we have, with four players who own their wireline and their wireless assets.

In “Thoughtful policy”, I cited a recent Financial Post article by economists Dr. Jeffrey Church and Dr. Christian Dippon. The article notes how so many observers of Canada’s telecom markets “mistakenly attribute all price differences to differences in competition.” In reality, a number of factors that can have significant impacts on costs vary between countries. “In other words, prices will differ even if “competition” is the same.”

In “Thoughtful policy”, I cited a recent Financial Post article by economists Dr. Jeffrey Church and Dr. Christian Dippon. The article notes how so many observers of Canada’s telecom markets “mistakenly attribute all price differences to differences in competition.” In reality, a number of factors that can have significant impacts on costs vary between countries. “In other words, prices will differ even if “competition” is the same.”

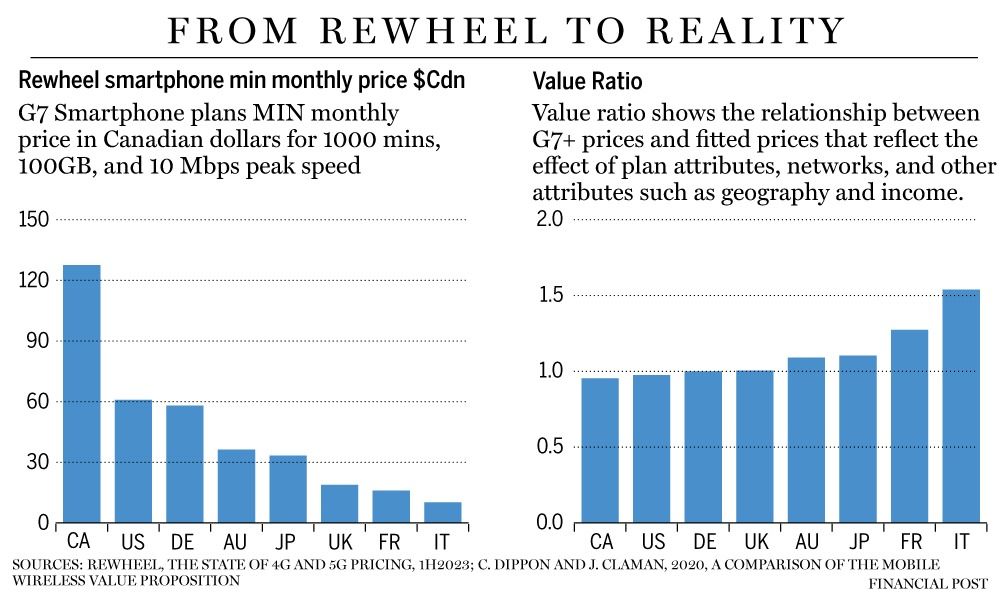

Using multiple regression analysis, it is possible to develop a model to account for variables such as “the quality of network service, availability of family plans, consumer preferences, income, availability and terms of handset provision, alternatives to wireless services, costs of provision, and the institutional / regulatory / legal environment”. Using such an analysis, it is possible to compare market prices to the statistically predicted price, to produce what Dr. Dippon calls a “value ratio” (as shown in the figure).

Measuring price without consideration of variances in quality produces meaningless results. “Value” seems to be a much more relevant metric.

Policy makers need to look at factors beyond price as a measure of competitiveness. The marketplace is working. As I told the Canadian Press a couple weeks ago, price reductions we are seeing in the mobile market are “well beyond any of the expectations that were set by Ottawa”.

So, are authorities in Ottawa preparing to declare “mission accomplished”? That would be unlikely. However, with the recent substantive changes in the structure of the sector, it might be appropriate to ask if regulators should stand aside and let marketplace dynamics work.

A recent Globe and Mail survey of Canada’s top chief executive officiers found that more than 60% of CEOs “believe Canada is on the wrong track when it comes to being a place for business to invest”. That should be a source of concern for policy makers.

Canada’s four facilities-based national competitors are spending billions of dollars extending and upgrading their wireless and wireline networks. That work is not complete. Policies need to support and encourage these continued levels of investment. And that usually calls for a lighter touch.

Canada’s future depends on connectivity.

In the right hand chart, is value being measured by proximity to 1.0 or by the highest x axis value?

The value ratio looks at the market price divided by the statistically predicted price. Less than 1.0 means prices represent better value than predicted; above 1.0 means less value.