Many questions raced through my mind in the wake of the late Friday night announcement of a deal for Quebecor (Videotron) to acquire Freedom Mobile as a remedy to address Competition Bureau concerns about the Shaw – Rogers transaction.

The deal sees Quebecor pay $2.85B to acquire “all of Freedom branded wireless and Internet customers as well as all of Freedom’s infrastructure, spectrum and retail locations. It also includes a long-term undertaking by Shaw and Rogers to provide Quebecor transport services (including backhaul and backbone) and roaming services.”

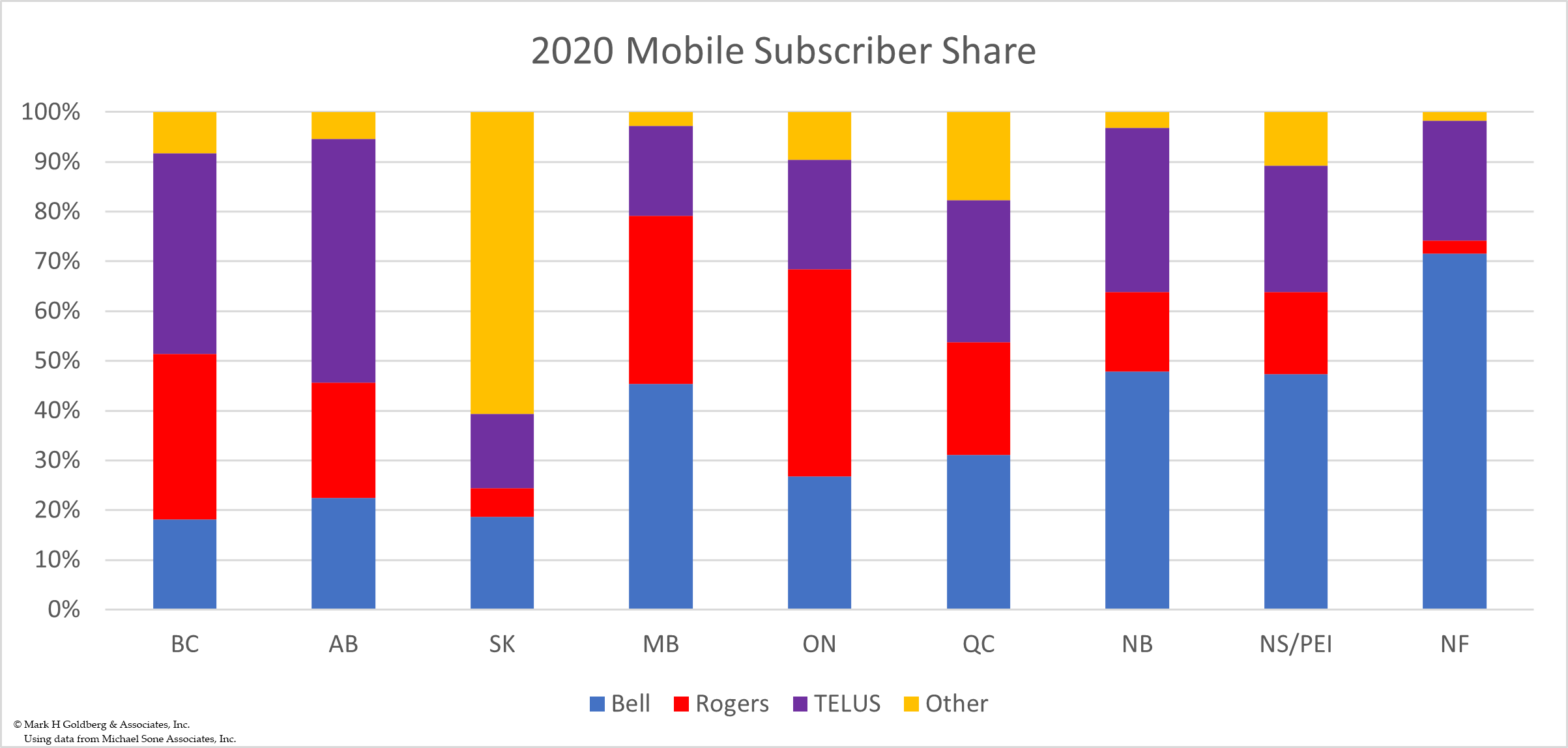

Upon closing, Videotron will be a facilities-based mobile competitor in Canada’s 4 most populous provinces, covering 13 of the country’s 15 largest cities – the company will still not have a presence in Manitoba, Saskatchewan or the Atlantic provinces. Videotron will have mobile spectrum covering about 85% of Canada’s population. Of all the new entrants in Canada’s mobile market, Videotron has secured the strongest share of subscribers in its home province of Quebec.

As an aside, let me remind readers that long before CRTC Chair Ian Scott indicated a preference for facilities-based competition during an interview in May, 2021 at The Canadian Club, in its submission to the CRTC in 2019, the Competition Bureau stated as a matter of fact “All else equal, facilities-based competition is the most sustainable and effective form of competition.”

In earlier posts, I indicated that I envisioned a different outcome, spinning off Freedom to Xplornet, but it appears that the Competition Bureau was as enamored with my Kobayashi Maru scenario as Star Fleet Academy was with officer-candidate Kirk. I can handle such rejection.

What does a divestiture of Freedom Mobile to Videotron mean for competitive providers operating in other provinces? Could we see the emergence of a cooperative alliance between the “other” service providers in Saskatchewan (SaskTel), Manitoba (Xplornet), and Atlantic Canada (Eastlink)? What advantages might arise in doing so?

Competition in the Alberta marketplace will be interesting to watch. According to data from Michael Sone Associates “2021 Mobile Wireless Communications & 5G Services Market Report”, TELUS had about half of the market, Freedom had about 5% and Rogers and Bell split the remainder. Freedom has a higher share of BC and Ontario, ranging from 8% to 10%. Saskatchewan could also face some significant shifts, since Rogers is seeking to acquire Shaw’s wireline operations, and be in a position to be the first to offer full home service bundles in competition with incumbent SaskTel.

Having reached this point – announcing a deal with Quebecor – one might expect that there have already been discussions with the Competition Bureau and the Minister’s office. Will the transaction be sufficient to gain the necessary final approvals enabling these multi-billion dollar deals to close?

What branding and approach to marketing will Videotron use in its new markets? As the deal gets reduced to contractual terms, will Videotron and Rogers come to an agreement on outstanding litigation between the parties?

Will the timetable for approvals be completed in time for the new industry structure to participate in the important back-to-school marketplace?

More questions (and hopefully, even more answers) will arise in the coming weeks. Always interesting times in the Canadian telecom space!