On July 25, just two months from now, applications and pre-auction deposits are due for Canada’s 3800 MHz spectrum auction. The list of applicants (and beneficial ownership and associated entities information) should be published by the end of July, and the finalized list of approved bidders will be released by mid-August. The auction is slated to begin October 24.

The 3500 MHz and 3800 MHz spectrum bands are often characterized as “Goldilocks spectrum”, offering a balance between capacity and coverage. The propagation characteristics of such midband spectrum allow signals to travel for miles and penetrate buildings, while transmitting significant amounts of data. Lower band spectrum provides coverage of large areas but lacks the data transmission capacity; higher band spectrum carries high capacity, but cannot provide significant coverage.

Last year, in the complementary 3500 MHz auction, Canadian carriers spent a record C$8.91B, C$2.26 per MHzPop, roughly ten times the C$0.23 bid in the UK auction for 3500 MHz spectrum and double the C$1.23 bid in the US for 3700 MHz spectrum.

The total amount of opening bids for one unencumbered block of 10 MHz across Canada would be $46.83M in the upcoming 3800 MHz spectrum auction. In the previous 3500 MHz auction, the comparable opening bid amount was slightly lower ($46.7 million).

In the wake of the record spending in the 3500 MHz auction, I wrote that spectrum scarcity and the auction structure were being blamed for driving up the costs of mobile service in Canada. A significant proportion of the 3500 MHz spectrum, up to 50 MHz, was reserved for bidding by carriers other than Bell, Rogers and TELUS.

By contrast, there will be no set-aside in the upcoming 3800 MHz spectrum auction. Instead, there will be a “cross-band spectrum cap”, limiting companies to a total of 100 MHz in combined 3500 MHz and 3800 MHz spectrum. The net effect of the cap is that 150 MHz of the total will be available for regional carriers and wireless internet service providers (WISPs).

National Bank Financial’s recent preview of the 3800 MHz spectrum auction says “We don’t think aggregate spending will reach or exceed the level of the 3500 MHz auction given more available supply and less inherent demand due to the 100 MHz cross-band limit.” The 3800 MHz auction has 250 MHz available (3650 MHz – 3900 MHz), compared to an average of 110 MHz of spectrum in the 3500 MHz auction, of which 50 MHz was set-aside for regional service providers. National Bank notes that some observers have suggested auction spending as low as $2B or as high as $11B. “We think the 3800 MHz auction could see spending in the range of $4B to $6B or perhaps even more narrowly within a zone of $4.5B to $5.5B as reflected in the medium scenario”.

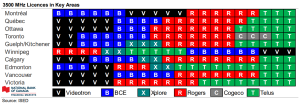

An interesting factor that could impact bidding levels is whether carriers will be seeking contiguity in spectrum holdings between the 3500 MHz band and the new 3800 MHz spectrum. In many of Canada’s major cities, TELUS holds 3500 MHz spectrum licenses at the upper end of the band, which would be contiguous with the lower portions of the 3800 MHz band.

An interesting factor that could impact bidding levels is whether carriers will be seeking contiguity in spectrum holdings between the 3500 MHz band and the new 3800 MHz spectrum. In many of Canada’s major cities, TELUS holds 3500 MHz spectrum licenses at the upper end of the band, which would be contiguous with the lower portions of the 3800 MHz band.

As National Bank notes,

Ideally, carriers will acquire 3800 MHz spectrum close to their 3500 MHz licences, but this isn’t a given and we’re talking about a 450 MHz range across the 3500 MHz and 3800 MHz bands. The relevance here is that spectrum contiguity helps reduce equipment spending and allow for related power efficiencies, especially when radios work within a 200 MHz band range after which more radios and carrier aggregation are required. Bell is positioned at the low end of the 3500 MHz band, with TELUS at the high end. As such, all the Big 3, in theory, would want to acquire spectrum at the lower end of the 3800 MHz band, but TELUS, in particular, may push hardest here to capitalize on contiguity.

The auction will be conducted at the Tier 4 level, meaning there are 172 localized service areas up for grabs. However, keep in mind that roughly 40% of Canada’s total population from the 2016 census (35,150,713) lives in just 3 of those 172 service areas: Toronto (license area 4-077) has a population of 7,030,750, representing 1 in 5 Canadians; with a population of 4,352,037, the Montreal license area (4-051) represents about twelve and a half percent of Canadians; and, Vancouver (4-152) has a population of 2,731,567 (just under 8%).

Deployment conditions for the 3 major cities are a little tighter than the requirements for the next 21 service areas, which are also more stringent than the remaining 148 Tier 4 service areas. Compliance with the deployment conditions are a requirement for any renewals. In addition, the government plans to monitor compliance with deployment conditions at various intermediate dates.

Where, at any point in the licence term, the licensee is not in compliance with its deployment conditions, ISED may invoke various compliance and enforcement measures. These measures may include warnings, administrative monetary penalties, legal action, licence amendments, suspensions, or other measures. In certain cases of non-compliance, ISED may determine that the most appropriate course of action is to revoke the licence.

The mid-band spectrum auction will be raising billions of dollars for the federal treasury, representing billions of dollars of additional investment by facilities-based service providers to enhance the quality and coverage of their wireless networks.

We’ll be watching this file over the coming months.