“Wholesale telecom services are a lot like selling the big guys’ hand-me-downs.”

That’s how a then-independent telecom journalist described the non-facilities based service providers a few years ago.

On paper, the wholesale scheme seems to make sense: Big network owners are forced to provide airtime to any and all commercial interests at regulated terms and rates, which other companies then resell to consumers at whatever prices they see fit.

…

But in the grand scheme of things, it’s worth asking whether the whole wholesale regime has really accomplished anything.

He concluded with “If the government is going to consider regulated wholesale wireless access, it would have to ensure that it doesn’t just enable hand-me-down services. Realistically, though, that hasn’t happened elsewhere so there’s no reason to expect it would in this situation.”

The 2013 article speaks of the ineffectiveness of a 10% market share for US mobile resellers (Mobile Virtual Network Operators, or MVNOs) as “the best reason for why the Canadian government shouldn’t be – and probably isn’t – thinking of wholesale service as a solution to what ails the country’s wireless market.” [CRTC figures show that Canada’s wholesale-based internet service providers still have less than 10 percent market share [xlsx] after well over a decade of regulated access to wholesale highspeed internet service.]

In the years subsequent to this article, we have seen the capital intensive nature of telecommunications globally drive consolidation in the MVNO marketplace. The two largest US MVNOs, Tracfone and Cricket, have been acquired by Verizon and AT&T, effectively turning these two MVNOs into flanker brands of the mobile giants.

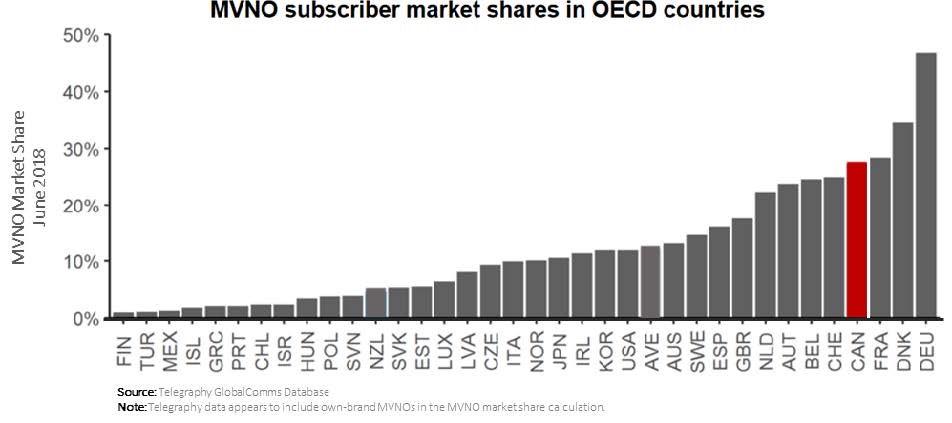

MVNOs continue to exist in Canada on a non-mandated basis and Telegeography data (filed by CWTA in its Wireless Review intervention [pdf]) shows that the market shares of Canada’s flanker brands (own-brand MVNOs) combined with MVNOs is among the highest in the OECD.

Last summer, Cabinet told us “Canada’s future depends on connectivity”, signalling quite strongly that the CRTC’s August 2019 rates “do not, in all instances, appropriately balance the policy objectives of the wholesale services framework and is concerned that these rates may undermine investment in high-quality networks, particularly in rural and remote areas.” Throughout its statement, Cabinet was clear in stating that preserving incentives for network investment was missing from the August 2019 wholesale framework.

A great body of economic evidence and observations from markets around the world has been provided to the CRTC to assist in its deliberations on varying its wholesale internet rates decision and its review of wireless services.

As reported here a couple weeks ago, a recent communiqué from the Telecommunications Working Group of the C. D. Howe Institute (chaired by the Dean of McMaster University’s DeGroote School of Business) concluded “Investment in the telecommunications sector is vital for ensuring Canada’s next generation digital infrastructure.”

Balancing Quality, Coverage and Price. It takes investment, massive levels of private sector investment, to drive quality and increase coverage. Prices have been coming down thanks to facilities-based competition.

MVNOs can continue to exist without regulatory intervention (like in most countries), where carriers and operators are able to identify business opportunities that make sense.

As that former journalist wrote, wholesale telecom services aren’t the solution.