Scotia Capital has released some new reports on the Canadian wireless market, one in direct response to news late last week about a new offer by TELUS to acquire Mobilicity.

Scotia Capital has released some new reports on the Canadian wireless market, one in direct response to news late last week about a new offer by TELUS to acquire Mobilicity.

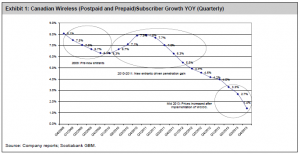

The other report, Scotia’s Converging Networks report for the week of March 31, observes “At this pace, we are trending toward no subscriber growth and no penetration growth in 2014.”

The Scotia Capital report sees revenue growth also slowing. Price increases have had a slowing effect on service revenue growth and data revenue growth, caused primarily by slower growth in smartphone subscribers (and smartphone penetration growth), which fuel data revenue growth. “As smartphone subscriber and smartphone penetration growth slow, so does data revenue growth.”

In the report on the TELUS – Mobilicity transaction, Scotia Capital states:

- TELUS tried to acquire Mobilicity in mid-2013 and unofficially again later in 2013 but was rejected both times by Industry Canada (IC). Mobilicity has been under CCAA since Sept 2013 and received 5 official bids. Mobilicity stated TELUS is the only one acceptable. In the Mobilicity release, there were a number of concessions if the transaction is approved.

- We believe that this deal is “dead on arrival” for the regulators but at this point, there is no real downside to TELUS’ move. Plan A is to have the bankruptcy court overrule IC’s rejection. If the court sides with IC, then we think that plan B would be for Mobilicity to pursue the next bid (or wait for another lower offer to emerge). The lower offer would help Mobilicity crystallize the “damage” for potential legal action against IC in the future.

- We do not believe IC will budge on allowing the transfer of set-aside spectrum licenses to the incumbents. Prices are again on the rise and we are not sure what victory the government can really declare. We believe IC is determined to devalue Wind and Mobilicity to the point that it becomes attractive for consolidation. It is not even clear that IC will even let SJR or QBR sell their spectrum licenses to RCI under their option agreements.

It is a powerful set of observations on the level of intervention by Industry Canada in the wireless marketplace. In one bullet, Scotia Capital observes that there could be lawsuits against the government for changing the spectrum transfer rules (potentially with 9 figure damages), and in another bullet, Scotia suggests the government is intentionally devaluing two of the new entrants.

Is this consistent with the spectrum transfer rules that were the subject of a blog post last week? Those rules require that “market forces should be relied upon to the maximum extent feasible” and “regulatory measures, where required, should be minimally intrusive, efficient and effective.”

The people who will lead the development of Canada’s digital future are gathering in Toronto from June 16-18 at The 2014 Canadian Telecom Summit. Now in its 13th year, this year’s event will explore a theme of “Future-proofing Our Place in a Digital World”, examining the technologies, services, systems, regulations and policies that are at the foundation of a global digital economy.

The state of telecom competitiveness in Canada will be the subject of a panel on Monday June 16, featuring some of North American’s leading telecom economists. The convergence of content anywhere is the subject of a panel that will be moderated by Scotia Capital’s Jeff Fan, also on June 16. Be sure to book your place at The Canadian Telecom Summit, June 16-18, in Toronto.